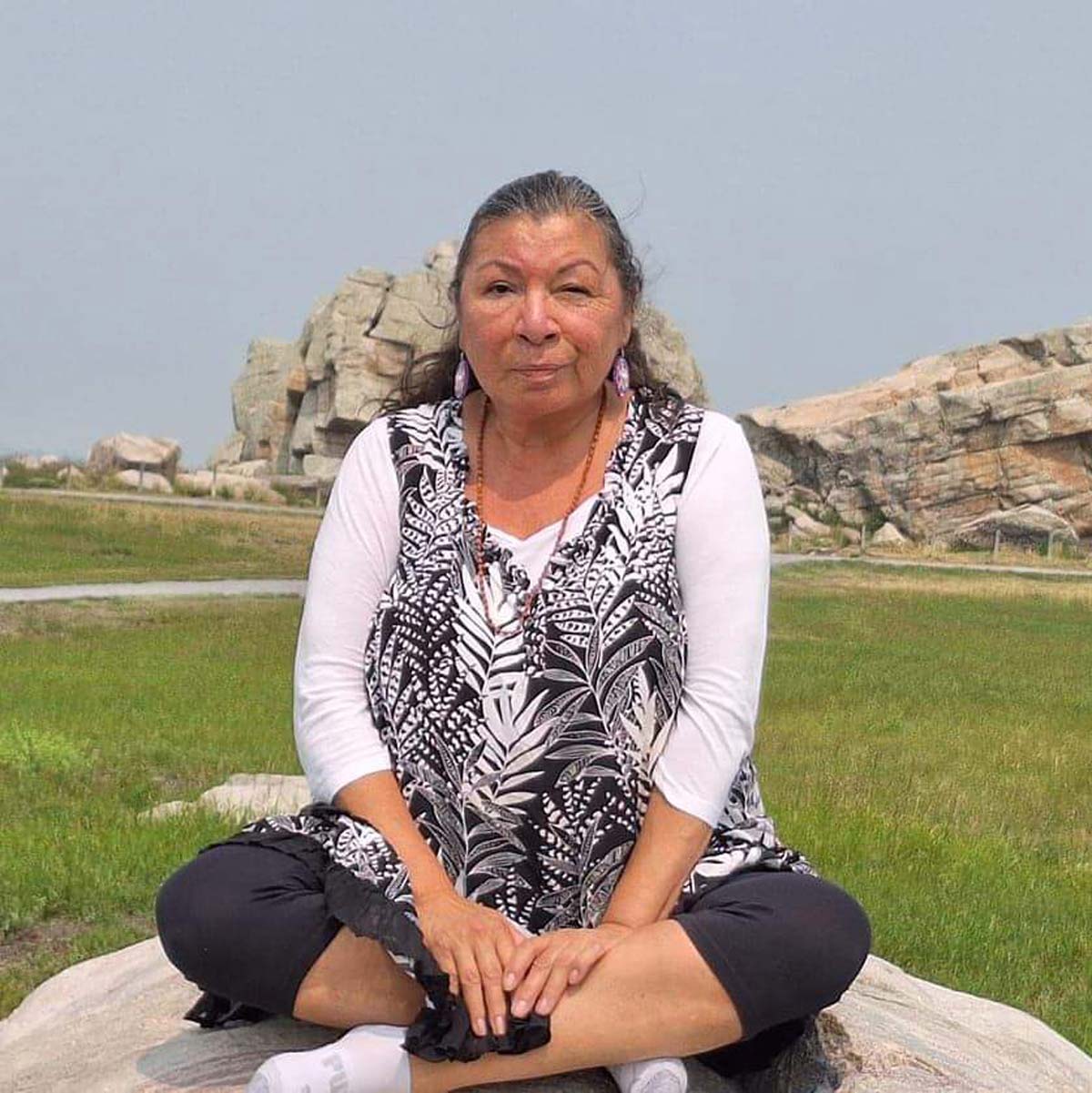

EDITOR’S NOTE: Professor Karen J Pheasant-Neganigwane of Wiikwemkoong is a professor at the University of Alberta. She has offered her thoughts on the dispersal of funds from the Robinson Huron Annuities settlement.

Boozhoo, Ahnii, greetings to my relatives of the Robinson Huron Treaty region,

On June 17, 2023, the Robinson Huron Treaty Litigation Fund leadership and representatives of the governments of Canada and Ontario announced a proposed out-of-court settlement in the outstanding litigation around the 1850 Robinson Huron Treaty. Negotiators for the parties reached a proposed settlement that includes $5 billion from both Canada and Ontario, for a total settlement of $10 billion for past losses. This is a major milestone in ongoing collaborative work to renew the Treaty relationship and honour a treaty promise that dates back to 1850.

Since this news release, communities and individuals have been expressing how the funds should be distributed. There exists a cause for concern, particularly among mothers, grandmothers and educators, with a concern for the future of our communities.

Let me introduce myself, as it may explain my background on the treaty settlement issue. Currently, I work away from my community, like my parents did, yet I am home often. Recently, I was an active member of the Wiikwemkoong Chief and Council Elders Council. I am the eldest daughter of Moses and Rosemary Lavallee. Maternal granddaughter of Alfred and Mary Jane Mishibinijima, as well my paternal grandparents were Sophie Ewewii and Mack (Michael) Lavallee/Dominic Wassegijig. I have a home in Wiikwemkoong, and grandchildren who attend Wiikwemkoong Board of Education schools today. All three of my children, parents of my eight grandchildren, attended Wikwemikong Schools. Having said that, this speaks to my vested interests to the future of our community.

My parents left Wiikwemkoong for work in the 1950s and never forgot their home roots, as both their families lived in Wiikwemkoong. Likewise, they raised their children to remain connected to our community. My brother contributed to the building of the high school, both my sister and I have been teachers within the school system, as my sister is to this day. In Cecil King’s book, ‘The Boy from Buzwah’ (2022), he describes my dad, who was also from Buzwah, Moses Lavallee as a “skilled arbitrator” (p. 58). We have had, and remain to have astounding educators from our community, as Dr. Cecil King was. This communication I hope represents how Dr. Cecil King defined my late Dad, as an arbitrator. My understanding of an arbitrator is one that gathers and analyze relevant information, keep biases in check (will do my best) and follow a procedure to be just.

Currently, I am a university professor in Alberta, and when I retire, I will return home as my parents did. There are two views of thoughts on the Treaty ligation and settlement, based on conversations with family members, community members and diverse social media posts. There are those who are wanting all the settlement funds be dispersed to everyone. The other position of is to re-invest the funds back into the communities, such as the much-needed infrastructure development that needs to occur in the community. I am an educator that teaches from an Anishinaabe perspective, as opposed to a colonial position, which Dr. King describes where the intent was to “de-Indianize” Anishinaabek, with the education department curriculum. Wikwemikong was fortunate to always have Anishinaabe educators over the years. Dr. King states that these teachers were “role models that it was possible to teach in the English world and still be Anishinaabe” (p.50). I bring this topic to discussion, as our curriculum remains problematic and remains with a focus for individuals to be focused on the greater good for self, rather than the greater good for all.

There are pros and cons to each scenario, of whether the funds are disbursed only to individuals or towards infrastructure. At this point, please understand, I can only speak specifically to First Nations who are connected and have relationships to on-reserve. As my knowledge of ‘60s Scoop individuals, who were raised away from the reserve community is limited on my part. There have been expressions of concern that individuals want every dollar to come to them, as they have “bills to pay.” Currently, I live and work in Alberta. When oil revenues were disbursed to individual band members in the ‘70s and ‘80s, I observed and witnessed the atrocities that happened in prairie province reserves. Historically, First Nations are amiss on financial literacy. In all honesty, my parents’ generation, those born prior to the Indian Act changes in 1951, are the first generation to be introduced to financial gain, as they were the first to have off reserve jobs, mortgages, and education for some.

I will name a few situations that occur when a windfall of funds is placed on individuals. I invite you to have conversations with others, particularly those who have witnessed the atrocities when instant influx of cash is available to individuals.

Vehicle and big toys (quads, boats, RVs) purchases. Please understand that there is nothing wrong with these purchases, but the reality is that outside vendors, like vultures, will find their ways to our communities. Prices are increased to the unknowing buyer. Reality is communities could be getting bulk buy discounts pricing. Case in point, there has been a presence of vehicle sellers at powwows.

Drug and alcohol issues. Unfortunately, I see drug dealers awaiting at the reserve boundaries and close town sites to take advantage of cash influx—this is a reality. Numerous research reports share this information.

Seniors/elders being taken advantage of. This is an awkward, controversial topic to address and have conversations about. It happens where homes are broken into, or victim stories told to gain sympathy finances.

Some individuals not able to gain an appreciation and understanding of what financial literacy is. In brief, what is financial literacy, you ask? One definition of financial literacy put forth by Investopedia is “the ability to understand and effectively use various financial skills, including personal financial management, budgeting, and investing.”

Another way to think about financial literacy is that it’s kind of like reading literacy, but for finances. The stronger your literacy skills are, the easier it is to interpret financial documents or topics and understand what they mean.

For further explicit discussion on this topic is a book by Chief Clarence Louie, ‘Rez Rules’ (2021). He has a chapter on the topic of Per Capita, which refers to money that goes directly into your pocket without a job being involved. It is a huge issue in Indian Country, with loud voices on both sides of the (free) coin (p. 80).

As I post these bullet point notes, and there could be more, but I want to keep this note brief. Some of you will debate that you can manage your personal finances, which is great. I am speaking to the general population, not to the rare anomaly. I have worked at Rainbow Lodge in the ‘80s, have worked within our school system, from K – 12 and now teach at the university level. It is these lived and learned experiences that guide me to question the idea of per capita windfall disbursements.

Speaking of schools, Wiikwemkoong schools, particularly the Junior and Pontiac school, have been in existence for decades and decades. The schools exist without current best practices. The plumbing, electrical systems, windows are all in dire need of repair. We have almost 1,000 students in our school system from preschool to secondary education. We always wave the banner, that our children are a priority, yet our actions are amiss of our rants.

Next is the banner of our elders. Everyone proclaims our elders are priority, yet again, our actions are off the mark. The Wiikwemkoong Nursing Home remains in fundraising mode to build a new elder’s home. Let our actions reflect our words.

Wiikwemkoong is the fourth largest reserve in Canada, both in land base and population base. We remain with extreme lengthy housing lists, several of its communities require water delivery and where cell service and wi-fi is limited or non-existent, whereas it is a standard in most small Ontario towns. We have sections of our reserve without basic services. I will conclude this section with words of Chief Leroy Wolf Collar (Niisitsipii) of the Siksika Nation/Alberta, in the book ‘First Nations Self-Government: 17 Roadblocks to Self-Determination, and One Chief’s Thoughts on Solutions’ (2020):

“Per capita distributions take away independence and self-determination. First Nations need to invest their money on job creation, housing, education, and trust accountants for the future of their children and youth…” (p. 83).

Further to this thought, Chief Clarence Louie states that he “agree a community’s wealth has to be used to touch every member, either as a wage or through programs and services” (p. 83). He further elaborates by stating that:

“per capita is a double-edged sword, in my opinion. There are positive and negatives to a community’s leadership dipping into the community’s bank account and handing out hundreds or thousands of dollars in a personal cheque. I’m not against per capita as long as the future generations are factored into the equation. We really need to think and seven generations ahead, as our real elders have always advised. We also need to respect past generations and their hopes and desires for their community. We need to think of our ancestors who suffered through the lean years and who passed away before any land claims settlement or multimillion-dollar pipeline deal. Any money settlement received also belongs to them, does it not? Any money made also belongs to those members who are buried. These members are usually the ones who started the community’s businesses and land claims.” (p. 84).

I could almost quote the whole chapter five of Chief Clarence Louies’ book. I will leave it to you, but his call out on “rocking chair money” sounds like a valid point. It is “money they never had to work for” (p. 86). He also spoke about the drugs and gangs that moved in because of windfall funds being released.

There are many proactive solutions to the financial gain being provided to Robinson Huron members. I will offer an idea that is also in Chief Clarence Louie’s book: A local government fund; a collage scholarship fund; a vocational education scholarship fund; a handicapped trust fund; an elder citizen’s trust fund; and a nationhood/Anishinaabe academy/prep school trust fund.

The above was based on what the Navajo nation did when they received a settlement of $217 million.

Reality is that due to colonialist policies and the ‘Kill the Indian, Save the Man’ oppressive mentality, there exists a knowledge base conundrum in our communities. In original Anishinaabe principles and philosophies we—particularly the grandparents—seriously consider seven generations ahead. We reflect, realize and appreciate what our ancestors lost for us as Anishinabek to be here today.

This communication is from an Nookomisag (grandmother) perspective. The future of our people is a hugely important consideration. Do your own research, talk to one another about what happened to other First Nations communities when funds were freely handed out. Ask yourself, is that worth it? Have face to face, voice to voice discussion, not anonymous social media rants. Be engaged, be insightful and thoughtful.

Miigwech

Karen J Pheasant-Neganigwane

Daughter of Rosemary and Moses Lavallee, mother of Sophie, Matthew and Jesse. Nokomis of Ezra, Kallie, Ezra, Francesca, Lilly, Mattelin, Olin and Jaxon.